John Pasmore, Founder and CEO of Latimer.ai, shared insights on AI and representation during the Black Women on Boards annual event held at Salesforce Tower in Chicago.

The update was shared in a LinkedIn post by Pasmore, who described the…

John Pasmore, Founder and CEO of Latimer.ai, shared insights on AI and representation during the Black Women on Boards annual event held at Salesforce Tower in Chicago.

The update was shared in a LinkedIn post by Pasmore, who described the…

By analyzing genetic data from more than 800,000 individuals across six ancestries, researchers have identified previously unknown obesity genes, opening new avenues for global, ancestry-informed treatments.

Study: Discovery of…

Mumbai, 31 October 2025 – Snapmint, one of India’s fastest growing EMI payments platforms (or “the Company”), today announced a new round of funding led by General Atlantic, a leading global investor. The round also saw participation from Prudent Investment Managers, Kae Capital, Elev8 Venture Partners and other existing angel investors. With this new capital, the Company plans to grow its Equated Monthly Instalments (“EMI”) on UPI offering and expand its merchant network. Financial terms of the investment were not disclosed.

Snapmint was founded in 2017 by Nalin Agrawal, Anil Gelra and Abhineet Sawa to bring honest and transparent EMI offerings to mass affluent consumers of India without the need of a credit card. Beyond the conventional categories of electronics, home and travel, Snapmint shoppers also use its EMI-on-UPI offering for fashion, furnishing and other lifestyle purchases. The Company today serves more than 7 million monthly active users across 23,000 pincodes in India and finances more than 1.5 million purchases every month

Nalin Agrawal, Co-founder of Snapmint, said: “We believe India will leapfrog credit cards and go straight to EMI on UPI. We have pioneered EMI on UPI since 2020 and have enabled brands to increase their sales by 10 to 20% with our offering. With this new funding, we are excited to have General Atlantic join our journey to bring EMI payment solutions to more than 100 million consumers in the next few years.”

Shantanu Rastogi, Managing Director and Head of India at General Atlantic, said: “Snapmint has built one of India’s largest EMI-on-UPI platforms, through its strong value proposition of affordability for consumers, and increased sales for merchants. We are excited to partner with Snapmint as it continues to scale its EMI payments platform and expand its network of merchants and customers.”

Prashasta Seth, Managing Partner of Prudent Investment Managers, said: “We are proud to have partnered with Snapmint since 2020 when they first started to build their EMI-on-UPI platform. Over the years, Snapmint has established market leadership and the founders have shown a steadfast commitment to building a sustainable and customer-centric business. As we deepen our partnership, we know that this is just the beginning of an exciting growth journey, and the best is yet to come.”

Radix Capital Advisors, led by Abhishek Taparia, has been Snapmint’s exclusive investment banking advisor since 2019.

About Snapmint

Snapmint is a Mumbai-based EMI payments company that provides seamless EMI payments on UPI without the need of a credit card. Founded in 2017 by IIT Bombay alumni – Nalin Agrawal, Anil Gelra, and Abhineet Sawa, Snapmint is on a mission to provide fair and transparent EMI options to young mass affluent consumers of India. The company has offices in Mumbai, Bangalore, Delhi NCR and Jaipur.

About General Atlantic

General Atlantic is a leading global investor with more than four and a half decades of experience providing capital and strategic support for over 830 companies throughout its history. Established in 1980, General Atlantic continues to be a dedicated partner to visionary founders and investors seeking to build dynamic businesses and create long-term value. Guided by the conviction that entrepreneurs can be incredible agents of transformational change, the firm combines a collaborative global approach, sector-specific expertise, a long-term investment horizon, and a deep understanding of growth drivers to partner with and scale innovative businesses around the world. The firm leverages its patient capital, operational expertise, and global platform to support a diversified investment platform spanning Growth Equity, Credit, Climate, and Sustainable Infrastructure strategies. General Atlantic manages approximately $114 billion in assets under management, inclusive of all strategies, as of June 30, 2025, with more than 900 professionals in 20 countries across five regions. For more information on General Atlantic, please visit: www.generalatlantic.com.

Media contacts

Shilpi Sinha

[email protected]

General Atlantic

Jess Gill

[email protected]

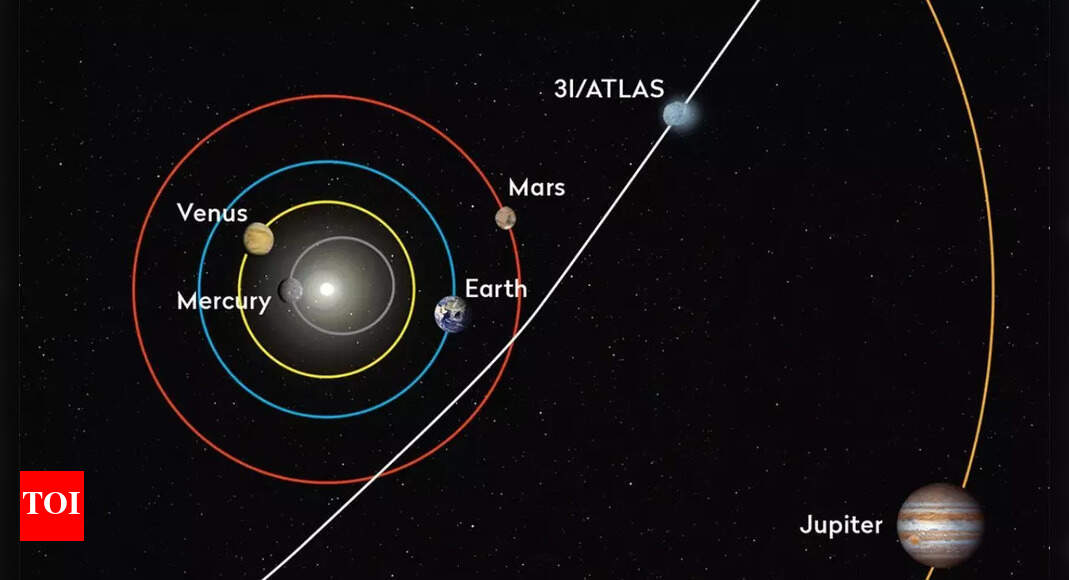

Astronomers have discovered an ancient, ice-rich interstellar object called 3I/ATLAS, which could transform our understanding of how comets form and evolve. Detected by the University of Oxford’s research team, this mysterious object is…

Seoul, South Korea

—

Three billionaires surprised diners when they walked into a popular fried chicken restaurant on Thursday – and picked up everyone’s bill.

Jensen Huang, CEO of the world’s most valuable company, AI chip giant Nvidia, went to the Seoul chicken-and-beer joint with the leaders of two of South Korea’s global tech titans: Samsung Electronics chairman Lee Jae-yong and Hyundai Motor Group executive chair Chung Eui-sun.

Fried chicken paired with ice-cold draft beer, known as “chimaek,” is a must-have for anyone visiting South Korea, and the tech potentates got their fill at Kkanbu Chicken in the heart of the nation’s capital, ahead of the APEC summit in Gyeongju.

“I love fried chicken and beer with my friends, so Kkanbu is a perfect place, right?” Huang told live-streaming passersby as he arrived at the restaurant. As well as being the name of the restaurant chain, “Kkanbu” is a slang word for a very close friend.

The three ate cheese balls, cheese sticks, boneless chicken and a fried chicken along with Korean beer Terra and the local rice spirit soju, according to national news agency Yonhap.

Video from local news outlets showed the trio – combined net worth $195 billion – linking their drinking arms to take a shot of beer, a gesture that, in South Korea, cements friendship while drinking.

Huang, Lee and Chung stepped out to offer chicken and cheese sticks to the assembled crowd.

“The chicken wings was so good. Have you been here before? It’s incredible, right?” Huang said when asked about his favourite items.

“Anyone? Fried chicken?” he offered as he held chicken baskets up.

When Huang rang the “golden bell,” a gesture to pay the bill for everyone in the restaurant, people cheered — though Samsung’s Lee paid the bill and Chung paid for a second round, according to Yonhap.

Fresh from his high-stakes trade talks with US President Donald Trump, Chinese leader Xi Jinping is among Asian heads of government who have descended on Gyeongju, in southern South Korea, for the APEC summit.

Access to cutting-edge AI chips – such as those that have pushed Nvidia to a market cap of about $5 trillion – is among issues being thrashed out between the US and China.

After their dinner at Kkanbu Chicken, the three leaders headed to Nvidia’s GeForce Gamer Festival, where Huang – flanked by Lee and Chung – promised to make a big announcement at the APEC summit on Friday.

“My announcements include my friends and we’re going to do amazing things for the future of Korea,” he told the crowd.

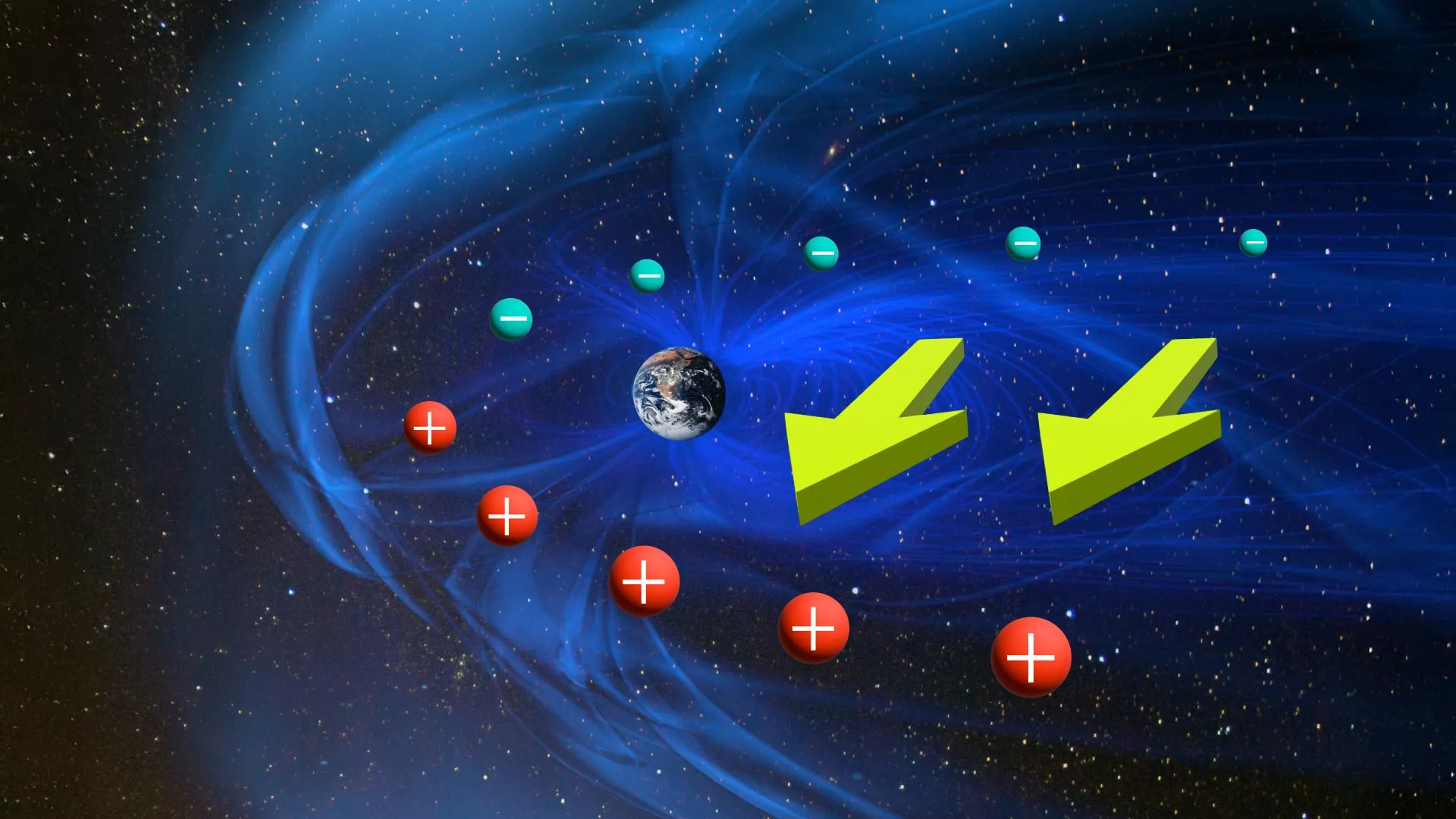

The area of space controlled by Earth’s magnetic field is called the magnetosphere. Within this vast magnetic bubble, scientists have observed an electric field that stretches from the morning side of Earth to the evening side. This large-scale…

“As we transition our portfolio, and connect our customers to a sustainable future, we need to ensure that today’s business remains productive and competitive in this changing market while we continue to invest in our business for tomorrow,” an AGL spokesperson said.

Sign up here.

Total cuts could be up to 300 roles, The Australian newspaper reported. The AGL spokesperson did not say exactly how many jobs out of its total workforce of about 4,200 would be cut.

“We understand this may be a difficult time for our people and we’re committed to communicating with transparency and respect and providing support throughout the consultation process,” the spokesperson said.

The company, which generates and sells power, has said previously that it plans to spend up to A$20 billion ($13 billion) in the next decade to build out clean energy and storage capacity to replace its ageing coal fleet.

AGL, which has the highest carbon emissions footprint in Australia, separately said on Friday it will buy four new gas turbines from Siemens AB for its Kwinana gas peaking power plant in Western Australia for A$185 million.

Reporting by Helen Clark; Editing by Sonali Paul

Our Standards: The Thomson Reuters Trust Principles.

Bernard Herrmann – The Murder (1960)

Scary music actually excites me, but the piece that most sends shivers down my spine is the music in the shower scene in Alfred Hitchcock’s film, Psycho. I’ve seen it numerous times and…

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Patti Smith’s 14th book arrives as the singer, poet and artist is midway through a tour to celebrate 50 years since the…